GPS Fleet Tracking: Sign Up Before 2023 and Save with Your Section 179 Deduction

As 2022 wraps up and your company plans for the New Year, you’re probably thinking about ways to run your operations more productively and cost-effectively in 2023. And hard as this might be to believe, the IRS actually has some great news for you.

As 2022 wraps up and your company plans for the New Year, you’re probably thinking about ways to run your operations more productively and cost-effectively in 2023. And hard as this might be to believe, the IRS actually has some great news for you.

The Section 179 Deduction Has Been Extended Through 2022

With Section 179 for Small Businesses, the IRS will allow your company to write off 100% of a business equipment purchase in the year you buy the item. You no longer have to spread that depreciation out over many years, writing off just a small percentage of the equipment’s price in any given tax year.

The rule applies to any type of business equipment: vehicles, machines, computers, furniture, personal property for business use, and software. And the IRS has extended this rule through the end of tax year 2022.

If you’ve been considering investing in new operating equipment for your business, pulling the trigger on those purchases before the end of 2022 could make a real difference come tax season. It could put more cash back into your business coffers.

In fact, you can even deduct the full value from this year’s taxes of any business equipment you finance or lease in 2022. In other words, even if you’ve only begun making payments toward new equipment by the end of this year—equipment it will take you years to fully pay for—you can deduct 100% of the value of that equipment right now.

If that sounds too good to be true, don’t take our word for it. Here’s what the official Section 179 web page says about this:

“The amount you save in taxes can actually exceed the payments, making this a very bottom-line friendly deduction. (You are reading this correctly; in many cases, the tax savings from the [Section 179] deduction will make your bank account larger than if you never financed the equipment in the first place.)”

How Section 179 Can Lower Your GPS Fleet Tracking Costs

Let’s review how this would work if your businesses wanted to sign up for a vehicle tracking solution with ClearPathGPS.

GPS Hardware (deduct 100% of the purchase price in 2022)

To equip your fleet with our live GPS vehicle fleet tracking solution, you’ll need to make a one-time purchase of tracking devices for each company vehicle you want to monitor. If you want to track other expensive assets—trailers, containers, or equipment your field techs haul to jobsites, such as compressors and generators—you can also purchase our GPS asset trackers and install them on your valuable equipment.

For any of these hardware purchases you make before tax filing in 2023, your company can deduct the full purchase price in tax year 2022.

GPS Software (deduct 100% of the subscription price in 2022)

Here’s where it gets really interesting. Let’s say you choose to sign up for the ClearPathGPS web-based fleet tracking service for 2 years. For all of the features and data that come with our tracking app—real-time vehicle status updates, live traffic overlays, vehicle health data, geofencing, virtual timecards, analytics and reporting, etc.—we charge an extremely affordable monthly rate (about $20) for each vehicle. That’s the good news. Here’s the great news.

Under Section 179, your company can claim a 100% deduction right now of the full 2 years’ worth of your subscription—even though you’ll only be making monthly payments for your GPS fleet tracking service.

What ClearPathGPS Solutions Qualify for the Deductions

Everything we offer is eligible for the Section 179 deduction. If you make your purchase by the end of the 2022 tax-filing season, you can reap the 100%-deduction benefit on all ClearPathGPS fleet- and asset-tracking hardware and software solutions, including:

Fleet dashcams

Never again rely on hearsay when your drivers get into a sticky situation. Whether at fault or not, dash cams give you the ability to resolve tough situations quickly and reliably.

GPS asset trackers

Know exactly where all of your company’s expensive equipment and other costly assets are at any given moment—so you can optimize your resources, improve your team’s productivity, and earn more revenue.

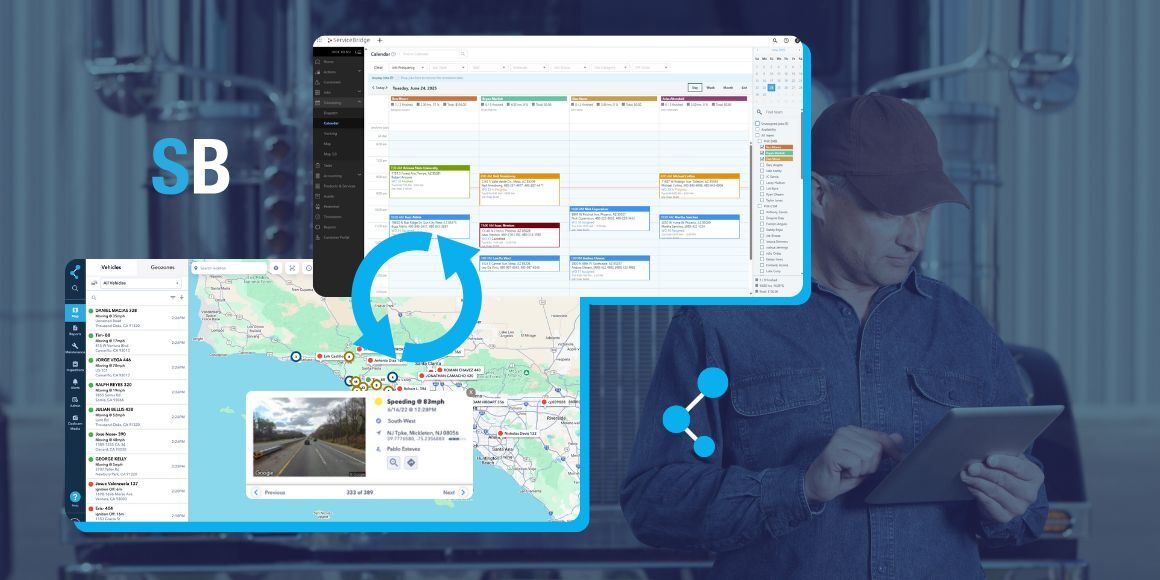

Live vehicle tracking software

Gain full visibility into your fleet, your drivers’ behavior, and your company’s resources in the field—24/7. ClearPathGPS’s fleet tracking software can help you improve your staff’s productivity, your customer service, and your business’s bottom line.

Lock in Your 2022 Tax Deduction Before December 31

More great news: Taking the next step is easy. Getting started with ClearPathGPS is quick and painless—and we can have your company up and running with a user-friendly fleet tracking solution in no time.