What Insurance Companies Offer Discounts for Dash Cams

When you think about dashcams, the first thing that comes to mind is usually safety. And while it’s true that dashcams protect drivers and businesses by providing valuable evidence, there’s another benefit many fleet managers overlook: insurance savings. More and more insurance companies are recognizing the value of dashcams, offering discounts to fleets that install them.

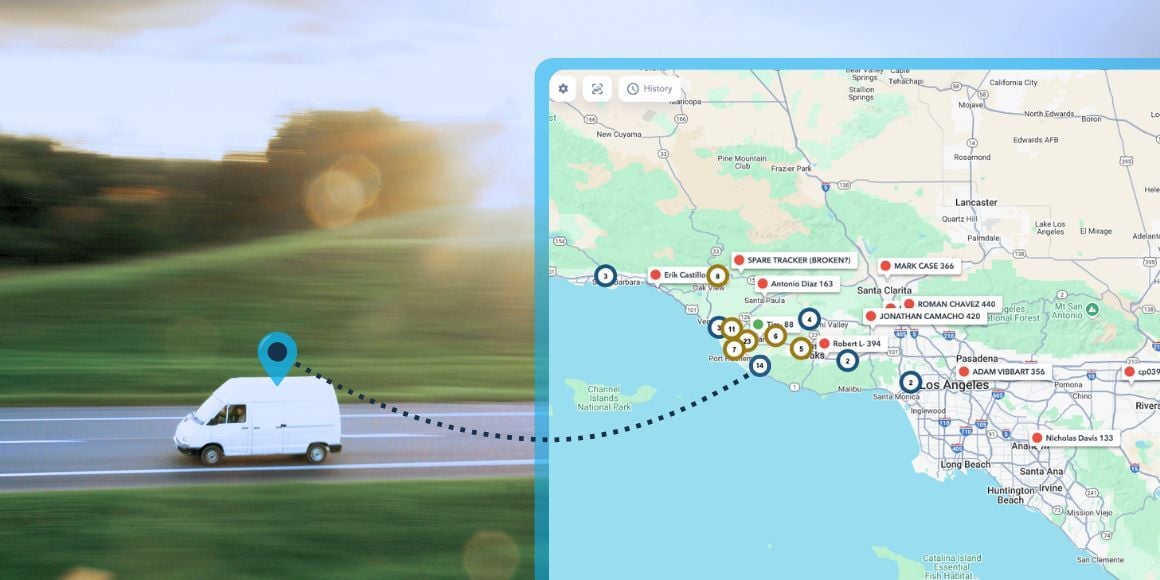

Why? Because dashcams reduce risk. By recording real-world driving behavior, they discourage reckless habits, provide context in case of accidents, and even help recover stolen vehicles. For insurers, that means fewer claims, lower payouts, and less uncertainty. As a result, many offer discounts of 10–15% or more for fleets that equip their vehicles with dashcams tied to GPS tracking.

Insight from Our Customers

One standout example comes from Merrell Brothers, a fleet that implemented ClearPathGPS dashcams to strengthen its operations. When faced with insurance renewal, the company was able to demonstrate improved driver behavior and provide hard evidence in case of disputes. Instead of facing the rate hikes common across the industry, they saved hundreds of thousands of dollars annually by leveraging their investment in video telematics.

Insurance carriers like Progressive, Nationwide, and others have developed commercial programs specifically designed to reward fleets that reduce risk with technology. By showing proof of your dashcam setup and sharing relevant driving data, you can qualify for lower premiums and, in some cases, faster claims resolution.

Dashcam Benefits Apart from Insurance Discounts

Beyond discounts, dashcams also pay for themselves in the way they protect your business. False claims can cost thousands in legal fees and settlements, even when your drivers weren’t at fault. Dashcam footage removes the guesswork, ensuring your business isn’t left holding the bill for an accident you didn’t cause. Combined with GPS insights on speed, routes, and driver behavior, insurers gain a full, objective view of your fleet’s risk profile.

If you’re looking to maximize your insurance savings, the best step you can take is to equip your fleet with dashcams that integrate seamlessly with your GPS tracking. Not only will you improve safety and accountability, but you’ll also unlock the financial benefits of lower premiums, reduced liability, and greater trust with your insurer.