Think You’d Be Prepared for an IFTA Audit Tomorrow?

First, the bad news.

If you operate a fleet-based business with vehicles regulated under the International Fuel Tax Agreement (IFTA), you need to be aware of these two unsettling facts.

If you operate a fleet-based business with vehicles regulated under the International Fuel Tax Agreement (IFTA), you need to be aware of these two unsettling facts.

1. According to its “Best Practices Audit Guide,” which IFTA publishes to help its member jurisdictions perform more effective audits on the businesses they regulate, each IFTA jurisdiction “must complete IFTA audits of an average of 3% per year of the accounts reported by that jurisdiction.”

2. The official IFTA Procedures Manual states that “in an IFTA audit, the burden of proof is on the licensee.”

In other words, your business has a small but real chance each year of being hit with an IFTA audit, even if you’ve never given any tax agency any trouble. Worse, according to IFTA’s own rules, once they decide to audit your company, you’ll have to prove your tax reporting is accurate if you want to avoid fines and penalties.

The Proof You’ll Need During an IFTA Audit

As if that weren’t concerning enough, consider that the quarterly IFTA filings can be some of the most complex, time-consuming, and difficult types of tax reports to prepare, because there is just so much data to keep track of.

For example, Section P540 of the IFTA Procedures Manual requires a business to maintain complete and accurate Distance Records that “substantially document the fleet’s operations and contain the following elements….”

the beginning and ending dates of the trip to which the records pertain

the origin and destination of the trip

the route of travel

the beginning and ending reading from the odometer, engine control module (ECM), or any similar device for the trip

the total distance of the trip

the distance traveled in each jurisdiction during the trip .035 the vehicle identification number or vehicle unit number

Keep in mind that IFTA’s regulators demand this level of record detail for every trip, taken by every vehicle in your fleet, on any given day of the quarter or year in question. That means your company will need to maintain:

-

Detailed mileage and state-travel records on every truck in your fleet

-

Aggregate mileage, state-travel and fuel-tax data on your entire fleet

-

Aggregate mileage, state-travel and fuel-tax data on any sub-fleets within your fleet

-

Time- or location-based mileage or tax reports for any requested time period

-

Accurate measurement conversions (from miles to kilometers, from gallons to liters) for the time your drivers have spent in Canada, which is also part of IFTA.

How Will You Keep Track of it All?

IFTA has been described by many fleet-based companies as an administrative nightmare (not to mention other terms we can’t publish here).

That’s because if you try to track and record all of this data manually—checking odometers every shift or demanding your drivers keep paper logs, recording every route in a spreadsheet, etc.—IFTA record-keeping can become one of your team’s most time-consuming ongoing tasks.

Fortunately, as more fleet-dependent businesses are learning every day, that’s not the only way to handle your IFTA reporting. We promised you good news, right?

The Good News: GPS Tracking Does Most of this IFTA Audit Stuff Automatically

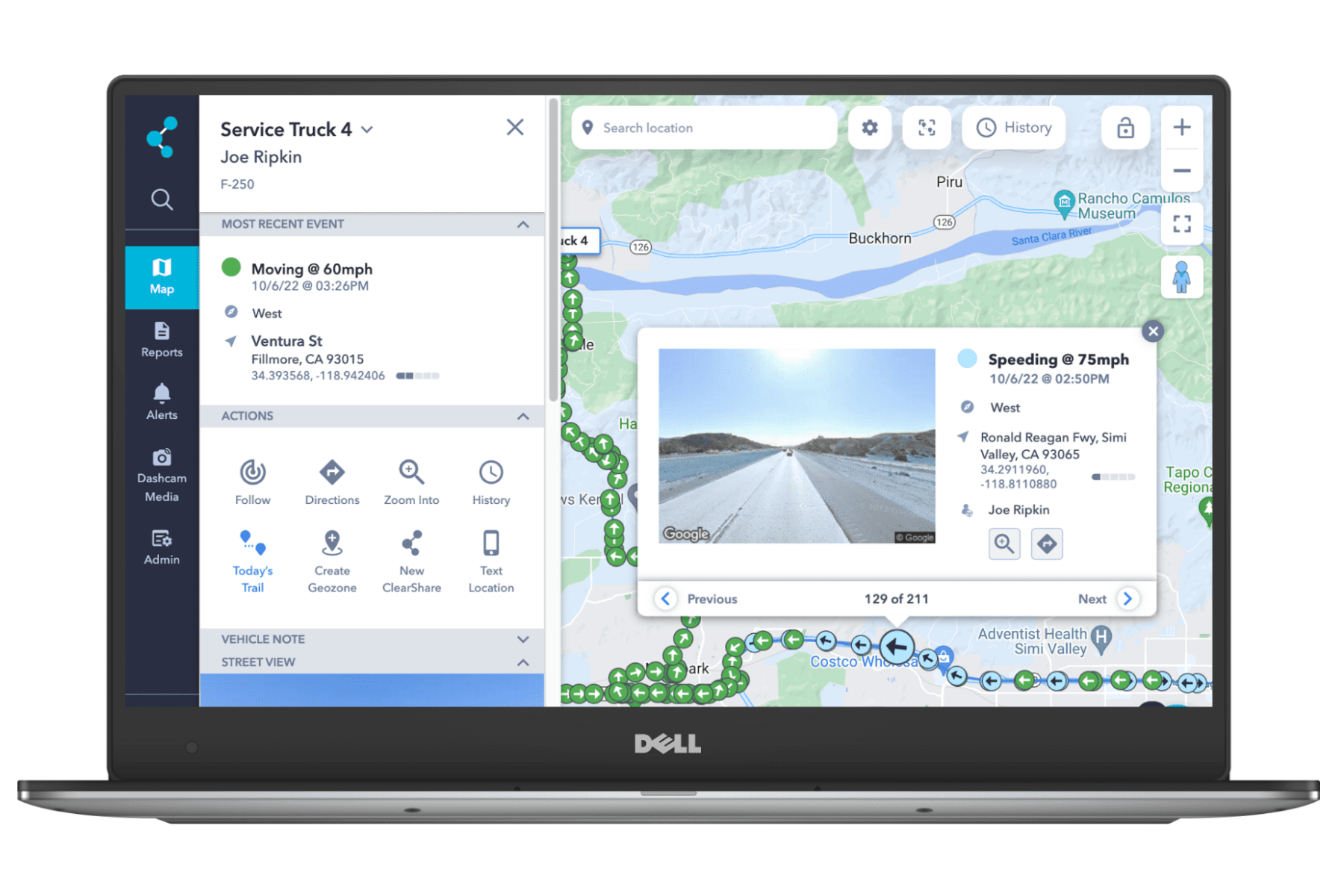

The good news is that you don’t have to make IFTA reporting a manual task. You can turn all of this data tracking and reporting over to your vehicle’s GPS tracking software—assuming you’re working with the right GPS fleet tracking company.

Because your fleet tracking system can do all of the heavy lifting we discussed above, it can help make your company’s IFTA compliance:

-

Paper-free

-

Spreadsheet-free

-

Error-free

-

…and headache-free!