How to Ease Commercial Auto Insurance Rates with GPS Fleet Tracking Software

Let’s get the bad news out of the way.

If your business insures a fleet of trucks or other vehicles, you should be worried about these stats cited in the Construction Executive.

- Research from Moody’s shows that commercial auto insurance premiums jumped 9.5% in 2018.

- That jump came after an increase of 7% in 2017.

- Worse still, researchers expect another average rate hike of 4% or 5% in 2019.

The article explains that most commercial auto insurers have been raising rates (from 5% to 25%) because increases in both the frequency and severity of auto losses are making the industry less profitable.

This means the average commercial auto rate is probably about to get even more expensive without fleet tracking software.

But that’s the end of our bad-news portion of the blog. Now for the good news.

Reduce both risks and auto insurance premiums

Your company doesn’t have to be the average commercial vehicle policyholder. You don’t have to watch helplessly as the industry drags your rates higher and higher each year.

By taking just a few smart steps and implementing GPS fleet tracking software, you can help protect your drivers’ safety, keep your vehicles safe, and perform at their best — and yes, even reduce the commercial auto insurance premiums on your fleet trucks.

Here’s the secret...

1. Create a safety-first company culture

One suggestion from Construction Executive is to create a company culture that focuses on driver safety.

We have a bunch of tips on building a safe-driver company culture right here at the ClearPathGPS blog — ideas like making company celebrities out of your safest drivers and creating contests to see which drivers and/or teams can build the best driving records.

2. Check your driver’s motor vehicle records

Your drivers aren’t going to tell you about every mishap they have on the road. But you can check in periodically to learn about the mistakes they’ve made where they got caught.

Review the motor vehicle records regularly of your field techs or any employees who drive your fleet trucks. Pulling these records annually is a good place to start, but even more frequently would be better.

If you discover that all of your drivers have had spotless driving records over the previous six months or year, that’s great. You can even submit this data to your insurer and ask for a discount.

And even if you discover problems on the records of some of your drivers, that early warning will put you in a better position to take action before those bad driving habits create a problem for your company.

3. Implement Fleet Tracking Software

Finally, one of the simplest and most effective steps you can take to reduce your commercial auto rates is to outfit your fleet trucks with the ultimate telematics solution: GPS fleet tracking software.

Why fleet tracking software? A couple of reasons.

First: By monitoring your drivers’ behavior, your company sends a signal to your insurer that you’re serious about their safety, the safety of others on the road — and yes, the health and safety of the vehicles and other assets your insurer is covering.

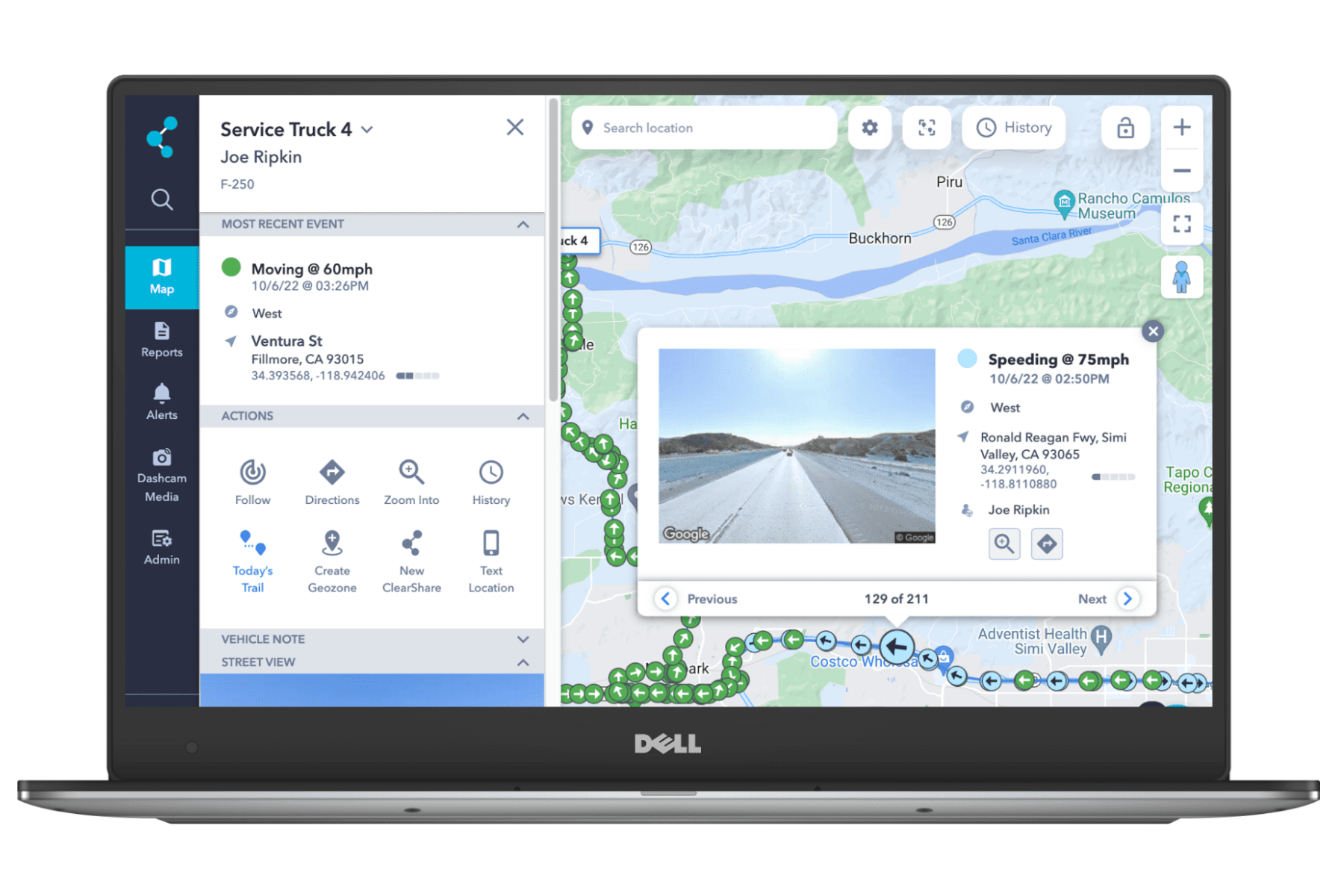

With the right fleet tracking software, you can capture real-time information about how your drivers are handling your trucks every minute they’re on the road. Are they complying with speed limits? Braking and accelerating appropriately? Cornering at safe speeds?

Combine this with our previous suggestion to create contests for on-the-road safety and highlight your best drivers, and you can see how this would allow your company to generate some impressive third-party proof of your drivers’ safe habits on the road — which you can also present to your insurer for a discount.

Second: Another reason auto insurers love GPS fleet tracking software is that they view them as a very effective anti-theft measure.

We can tell you from experience that the insurance companies are right. The ClearPathGPS trackers have also helped customers recover a stolen fleet truck they know they wouldn’t have gotten back otherwise. In fact, our truck tracking app has helped police thwart a truck thief more times than we can count.

Our customers won big — and so did their insurance companies.

That’s why commercial auto insurers offer such significant discounts for fleet tracking software, often 15% or even more. Learn more about ClearPathGPS will be the best-suited partner to help reduce those commercial auto insurance rates.

At ClearPathGPS, we are focused on helping our customers improve their operations and bottom line. Our top-rated GPS fleet tracking software provides real-time data insights and tools needed to more effectively manage the vehicles, people, and assets businesses send into the field every day. Can ClearPathGPS help your operations get better results? Let’s find out – request a demo today!