How to Deduct Vehicle Tracking Software

Are you still on the fence about signing up for vehicle tracking software? Maybe you're thinking of expanding your tracking capabilities to your other vehicles and assets?

You probably already know GPS fleet tracking can benefit your operations in plenty of ways, including quantifiable cost savings and helping your business run more efficiently every day. But thanks to Section 179 of the IRS Code, you have another great reason to sign up.

When you apply the 179 deductions to your GPS tracking solution, you’ll kill two birds with one stone: Set your business up for greater success for the upcoming year—and take advantage of an excellent tax deduction for your business.

Vehicle Tracking Software Section 179 Deductions

The rule is pretty much the same for the past two years. Businesses can still deduct the full purchase price of qualifying equipment bought or leased during the calendar year. The only notable difference is that this year the maximum equipment purchase price that qualifies for the 100% first-year write-off increased from $1,040,000 to $1,050,000.

And yes, qualifying equipment includes both GPS vehicle trackers and the software service you’ll use to monitor those trackers. There's no reason to get money back from the investments you have made for your business.

How to Get the 179 Deduction for Your Business

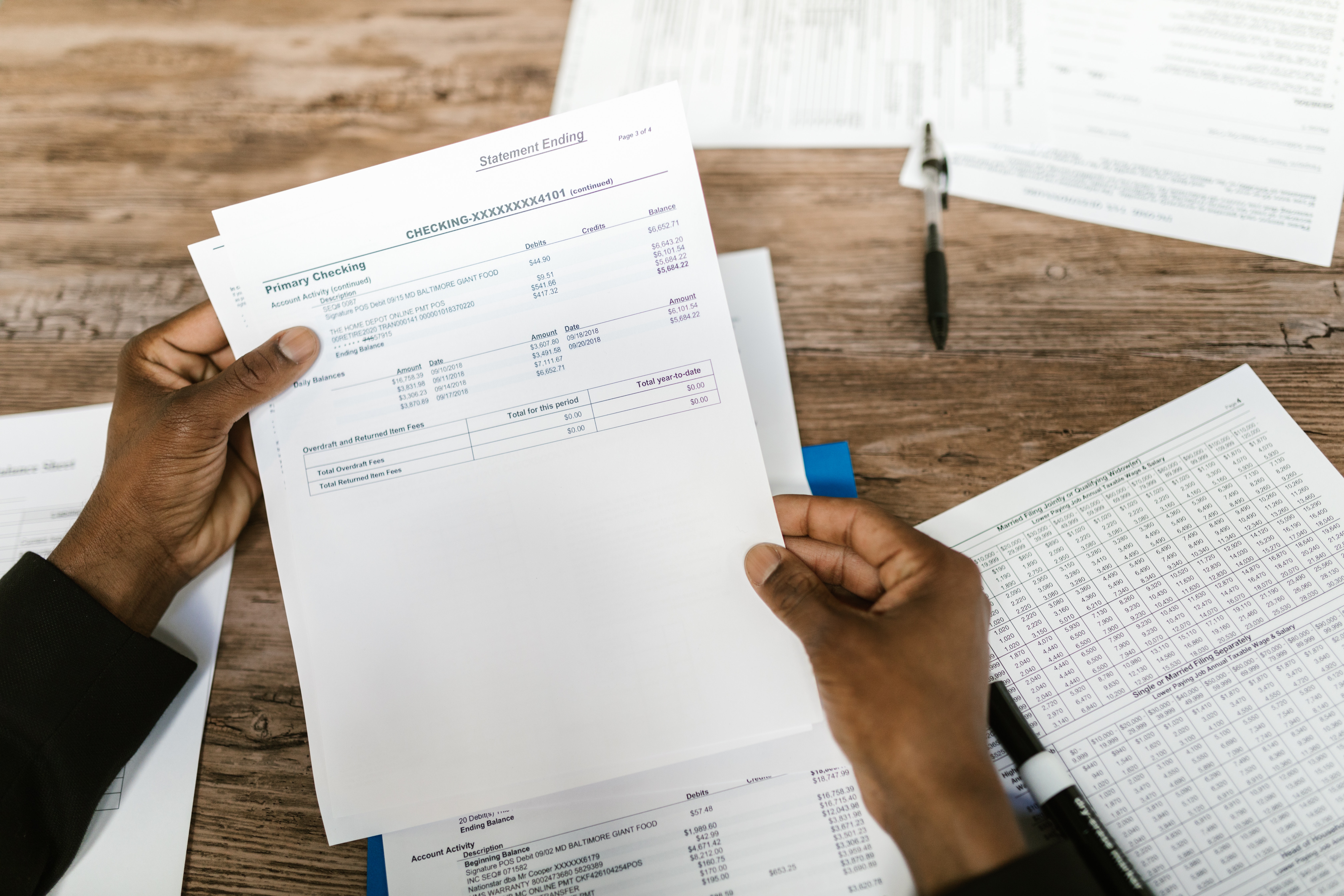

Let’s say your company has a fleet of 12 service vehicles using vehicle tracking software. Here’s what you’ll need to gain real-time monitoring and data analysis of your fleet—and all the operational benefits that come from it:

- 12 plug-and-play GPS tracking units, at $75 per device (one-time purchase)

- 12 “Pro” software licenses, at $25 per month per vehicle

For the eligible tracking devices, the out-of-pocket costs would be $900 to equip your fleet ($75 x 12). However, with the Section 179 deduction, that purchase will look like this:

![]()

And here’s where it can get very interesting.

When you sign up for ClearPathGPS, you won’t have to commit to any long-term agreement. You can pay for our service monthly and cancel anytime without penalty. In fact, as Business.com points out in their 2021 review—naming ClearPathGPS “Best for Affordability”—we’re one of the only GPS fleet tracking providers that don’t require any contract.

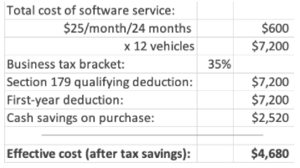

To take advantage of this Section 179 deduction for your ongoing GPS service, you could sign up for two years—and deduct that total amount from your business income this year. Here’s what that might look like:

And keep in mind: This applies to equipment, including vehicle tracking software that your business obtains with financing. In other words, you can deduct 100% of the price of a two-year software license from your 2021 income even if you lay out only a portion of the cash for it this year.

The Proof is in the Numbers

We didn’t arrive at these estimates by guessing. Those calculations above come directly from the IRS Section 179 calculator. Check it out for yourself. Plugin whatever numbers apply to your business to see how big the tax breaks will be for you.

And when we say don’t take our word for it, we also mean that you’ll need to consult with your accountants before making any business decisions based on their possible tax implications. After all, we’re an award-winning GPS provider—not an accounting firm.

You Still Need the Right Vehicle Tracking Software Provider

Remember, when it comes to signing up for a vehicle tracking solution, Section 179 should be the icing on the cake. The tax breaks can be great, but you first need to know you’re signing up for the right service. Make sure your GPS tracking provider:

- Receives outstanding customer reviews on sites like Trustpilot

- Offers flexible GPS tracking plans and doesn’t demand a multi-year contract

- Integrates with other workflow apps, like Fleetio and ServiceTitan, to make your staff even more productive and efficient

- Provides dozens of real-world customer success stories to prove that it truly helps businesses save money and grow

Ready to learn what it's like partnering with ClearPathGPS? Download our free eBook, Choosing ClearPathGPS as your Fleet Management Provider, or request a demo to see our solution live.

At ClearPathGPS, we are focused on helping our customers improve their operations and bottom line. Our top-rated GPS fleet tracking solutions provide real-time data insights and tools needed to more effectively manage the vehicles, people, and assets businesses send into the field every day. Can ClearPathGPS help your operations get better results? Let’s find out – request a demo or contact us today!